UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material under §240.14a-12 |

MINERALYS THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | No fee required |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

150 N. Radnor Chester Rd, Suite F200

Radnor, PA 19087

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Mineralys Therapeutics, Inc. The annual meeting will be held on May 22, 2024 at 12:00 p.m., Eastern Time. We will hold our annual meeting solely online via the Internet through a live webcast. We have designed the virtual format for ease of stockholder access and participation. The matters to be considered by stockholders at the annual meeting are described in the accompanying materials.

We have elected to take advantage of Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders by providing access to these documents on the Internet instead of mailing printed copies. Those rules allow a company to provide its stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting. Most of our stockholders will not receive printed copies of our proxy materials unless requested, but instead will receive a notice with instructions on how they may access and review our proxy materials on the Internet and how they may cast their vote via the Internet. If you would like to receive a printed or e-mail copy of our proxy materials, please follow the instructions for requesting the materials in the Notice of Internet Availability of Proxy Materials that is being sent to you.

Your vote is important. Whether or not you plan to attend the annual meeting online, we urge you to vote as soon as possible. You may vote over the Internet or, if you received a paper copy of our proxy materials, by telephone or by marking, signing, and dating your proxy card and returning it in the envelope provided. Voting over the Internet, by telephone, or by written proxy will not prevent you from voting by attending online but will ensure that your vote is counted if you are unable to attend. Please review the instructions on the Notice of Internet Availability of Proxy Materials or proxy card regarding each of these voting options.

Thank you for the interest and support you’ve shown Mineralys Therapeutics, Inc.

Sincerely,

| | | | | |

Jon Congleton Chief Executive Officer | Brian Taylor Slingsby, M.D., Ph.D., M.P.H. Executive Chairman and Founder |

| |

| |

150 N. Radnor Chester Rd, Suite F200

Radnor, PA 19087

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

| | | | | |

| DATE & TIME: | May 22, 2024 at 12:00 p.m., Eastern Time. |

| |

| PLACE: | This year’s annual meeting will be a virtual meeting, which will be conducted only via live webcast. Stockholders will only be able to participate in the annual meeting online and vote shares electronically by visiting www.virtualshareholdermeeting.com/MLYS2024. Instructions on how to attend the annual meeting online and vote shares are described in the accompanying proxy statement. |

| |

| ITEMS OF BUSINESS: | (1) To elect one director to serve as a Class I director for a three-year term to expire at the 2027 annual meeting of stockholders; (2) To ratify the appointment of Ernst & Young LLP as Mineralys Therapeutics, Inc.’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and (3) To transact such other business as may properly come before the meeting or any adjournment(s) thereof. |

| |

| RECORD DATE: | You are entitled to vote at the annual meeting or any adjournment of that meeting only if you were a stockholder at the close of business on March 25, 2024. |

| |

| VOTING BY PROXY: | Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) over the Internet, (2) by telephone, or (3) by mail. For specific instructions, please refer to the information in the proxy statement and the instructions on the Notice of Internet Availability of Proxy Materials or proxy card. |

BY ORDER OF THE BOARD

OF DIRECTORS,

Adam Levy

Chief Financial Officer & Secretary

Radnor, Pennsylvania

April 9, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON WEDNESDAY, MAY 22, 2024:

This Notice of Annual Meeting, the proxy statement, and our 2023

Annual Report to Stockholders are available at http://www.proxyvote.com.

TABLE OF CONTENTS

150 N. Radnor Chester Rd, Suite F200

Radnor, PA 19087

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, MAY 22, 2024

The board of directors of Mineralys Therapeutics, Inc. is soliciting the enclosed proxy for use at the annual meeting of stockholders, including at any adjournments or postponements of the meeting, to be held virtually on May 22, 2024 at 12:00 p.m., Eastern Time.

In this proxy statement, “Mineralys,” the “Company,” “we,” “us,” and “our” refer to Mineralys Therapeutics, Inc.

We have elected to take advantage of Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders by providing access to these documents on the Internet instead of mailing printed copies. Those rules allow a company to provide its stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting. Most of our stockholders will not receive printed copies of our proxy materials unless requested, but instead will receive a notice with instructions on how they may access and review our proxy materials on the Internet and how they may cast their vote via the Internet. If you would like to receive a printed or e-mail copy of our proxy materials, please follow the instructions for requesting the materials in the Notice of Internet Availability of Proxy Materials that is being sent to you.

To attend the annual meeting, you must register at www.virtualshareholdermeeting.com/MLYS2024 by 12:00 p.m., Eastern Time on May 22, 2024. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the annual meeting and to vote and submit questions during the annual meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials. If you are a beneficial owner of shares registered in the name of a broker, bank, or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank, or other nominee as part of the registration process.

On the day of the annual meeting, May 22, 2024, stockholders may begin to log in to the virtual-only annual meeting 15 minutes prior to the annual meeting. The annual meeting will begin promptly at 12:00 p.m., Eastern Time. Should you encounter any difficulties accessing the virtual-only annual meeting platform, including any difficulties voting or submitting questions, we will have technicians ready to assist you. You may call the technical support number that will be posted in your instructional email.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the JOBS Act). Accordingly, we have elected to comply with the scaled-down executive compensation disclosure requirements applicable to emerging growth companies and we are not required to include a Compensation Discussion and Analysis section in this proxy statement. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which votes must be conducted.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

We have prepared these proxy materials, including this proxy statement and the related proxy card, because our board of directors is soliciting your proxy to vote at the 2024 annual meeting of stockholders. This proxy statement summarizes information related to your vote at the annual meeting. All stockholders who find it convenient to do so are cordially invited to attend the annual meeting via live webcast. However, you do not need to attend the meeting to vote your shares. Instead, you may simply submit your proxy via the Internet in accordance with the instructions provided on the Notice of Internet Availability of Proxy Materials or if you elected to receive printed copies of the proxy materials, you may submit your proxy via telephone or by completing, signing and returning the enclosed proxy card.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules of the Securities and Exchange Commission (SEC), we use the Internet as the primary means of furnishing proxy materials to our stockholders. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders with instructions on how to access the proxy materials over the Internet or request a printed copy of the materials, and for voting over the Internet.

Stockholders may follow the instructions in the Notice of Internet Availability of Proxy Materials to elect to receive future proxy materials in print by mail or electronically by email. We encourage our stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our annual meetings and reduce the cost to us associated with the printing and mailing of materials.

We intend to mail the Notice of Internet Availability of Proxy Materials on or before April 11, 2024 to all stockholders of record entitled to vote at the annual meeting. You will need the control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable).

Why are you holding a virtual meeting instead of a physical meeting?

We believe that hosting a virtual meeting will enable more of our stockholders to attend and participate in the meeting because our stockholders can participate from any location around the world with Internet access.

What if I have trouble accessing the Annual Meeting virtually?

The virtual meeting platform is fully supported across browsers (Microsoft Edge, Firefox, Safari, and Chrome) and devices (desktops, laptops, tablets, and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong WiFi or internet connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it.

Only stockholders of record at the close of business on the record date for the 2024 annual meeting, March 25, 2024, are entitled to vote at the annual meeting. At the close of business on this record date, there were 49,631,159 shares of our common stock outstanding. Common stock is our only class of stock entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If, on the record date, your shares were registered directly in your name with the transfer agent for our common stock, Equiniti Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote your shares by proxy via the Internet by visiting http://www.proxyvote.com, by telephone, or by mail. You will need the control number included on your Notice of Internet Availability of Proxy Materials or

your proxy card (if applicable). Whether or not you plan to participate in the virtual annual meeting, we encourage you to vote by proxy via the Internet, by telephone, or by mail, as instructed below to ensure your vote is counted.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If, on the record date, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the virtual annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting, but you will need the control number provided on the voting instructions that accompany your proxy materials from your broker, bank, or other agent.

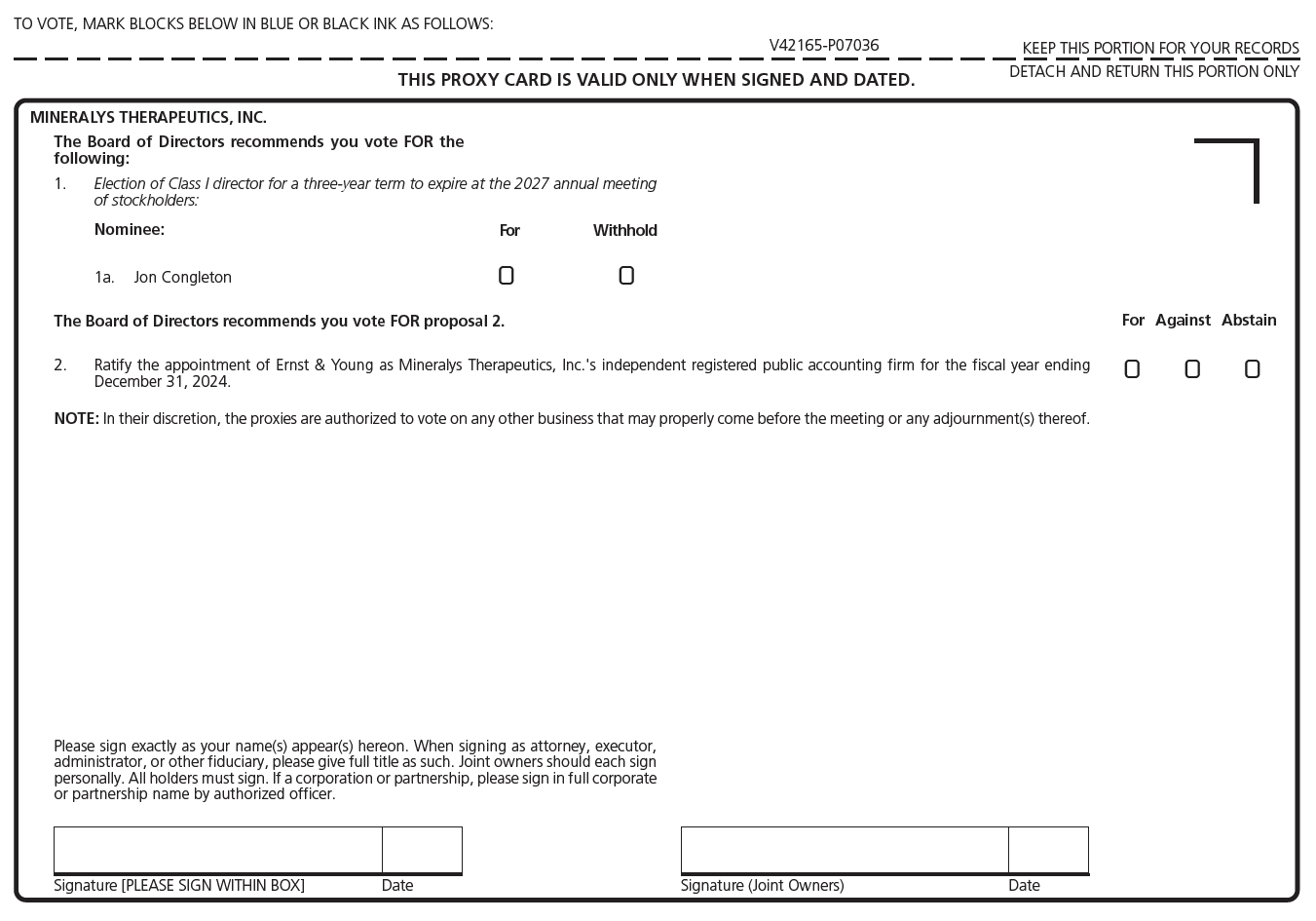

What am I voting on?

There are two proposals scheduled for a vote:

Proposal 1: To elect one director to serve as a Class I director for a three-year term to expire at the 2027 annual meeting of stockholders.

Proposal 2: To consider and vote upon the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024.

How many votes do I have?

Each share of our common stock that you own as of March 25, 2024, entitles you to one vote.

How do I vote?

With respect to the election of director, you may either vote “For” the nominee to the board of directors or you may “Withhold” your vote. With respect to the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, you may vote “For,” “Against” or “Abstain” from voting.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to attend the meeting, we urge you to vote by proxy prior to the virtual annual meeting to ensure that your vote is counted.

•Via the Internet: You may vote at http://www.proxyvote.com, 24 hours a day, seven days a week, by following the instructions provided in the Notice of Internet Availability of Proxy Materials. Votes submitted via the Internet must be received by 11:59 p.m., Eastern Time on May 21, 2024.

•By Telephone: If you request printed copies of the proxy materials by mail, you may vote using a touch-tone telephone by calling 800-690-6903, 24 hours a day, seven days a week. Have your proxy card available when you call and use the control number shown on your Notice of Internet Availability of Proxy Materials or your proxy card (if applicable). Votes submitted by telephone must be received by 11:59 p.m., Eastern Time on May 21, 2024.

•By Mail: If you request printed copies of the proxy materials by mail, you may vote using your proxy card by completing, signing, dating, and returning the proxy card in the self-addressed, postage-paid envelope provided. If you properly complete your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed.

•At the Virtual Annual Meeting: You may still attend the virtual annual meeting and vote during the meeting even if you have already voted by proxy. To vote during the meeting visit www.virtualshareholdermeeting.com/MLYS2024 on the day of the meeting; you will need the control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable).

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should receive voting instructions from that organization rather than directly from us. Please check with your bank, broker, or other agent and follow the voting instructions they provide to vote your shares. Generally, you have three options for returning your proxy.

•By Method Listed on Voting Instruction Form: Please refer to your voting instruction form or other information provided by your bank, broker, or other agent to determine whether you may vote by telephone or electronically on the Internet and follow the instructions on the voting instruction form or other information provided by your broker, bank or other agent. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank, broker, or other agent does not offer Internet or telephone voting information, please follow the other voting instructions they provide to vote your shares.

•By Mail: You may vote by signing, dating, and returning your voting instruction form in the pre-addressed envelope provided by your broker, bank, or other agent.

•At the Virtual Annual Meeting: If you want to vote virtually during the annual meeting, you must register in advance at www.virtualshareholdermeeting.com/MLYS2024 by 12:00 p.m., Eastern Time on May 22, 2024. You will be instructed on how to obtain a legal proxy from your broker, bank, or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

May I revoke my proxy or change my vote?

If you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the three following ways:

•you may send in another signed proxy at a later date,

•you may authorize a proxy again on a later date on the Internet (only the latest Internet proxy submitted prior to the annual meeting will be counted), or

•you may notify our Chief Financial Officer and Secretary, Adam Levy, at 150 N. Radnor Chester Rd, Suite F200, Radnor, PA 19087, in writing before the annual meeting that you have revoked your proxy, after which you are entitled to submit a new proxy or vote during the virtual annual meeting.

What constitutes a quorum?

The presence at the annual meeting, by virtual attendance or by proxy, of holders representing a majority of our outstanding common stock as of March 25, 2024, or approximately 24,815,580 shares, constitutes a quorum at the meeting, permitting us to conduct our business.

What vote is required to approve each proposal?

Proposal 1: Election of Director. The nominee who receives the most “For” votes (among votes properly cast at the annual meeting or by proxy) will be elected. Only votes “For” or “Withhold” will affect the outcome.

Proposal 2: Ratification of Independent Registered Public Accounting Firm. The ratification of the appointment of Ernst & Young LLP must receive “For” votes from the holders of a majority in voting power of the votes cast affirmatively or negatively on the proposal. Only votes “For” or “Against” will affect the outcome.

Voting results will be tabulated and certified by the inspector of election appointed for the annual meeting.

How will my shares be voted if I do not specify how they should be voted?

If you are a stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the board of directors, then your shares will be voted at the annual meeting in accordance with the board of directors’ recommendation on all matters presented for a vote at the annual meeting. Similarly, if you sign and return a proxy card but do not indicate how you want to vote your shares for a particular proposal or for all of the proposals, then for any proposal for which you do not so indicate, your shares will be voted in accordance with the board of directors’ recommendation.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, the organization that holds your shares may generally vote your shares at their discretion on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.”

What is the effect of withheld votes, abstentions, and broker non-votes?

Shares of common stock held by persons attending the virtual annual meeting but not voting, and shares represented by proxies that reflect withheld votes or abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum. Abstentions are not an affirmative or negative vote on a proposal, so abstaining does not count as a vote cast and has no effect for purposes of determining whether our stockholders have ratified the appointment of Ernst & Young LLP, our independent registered public accounting firm. The election of director is determined by a plurality of votes cast, so a “Withhold” vote will not be counted in determining the outcome of such proposal.

As discussed above, a broker non-vote occurs when an organization holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. With regard to the election of director, which is considered a non-routine matter, broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. However, ratification of the appointment of Ernst & Young LLP is considered a routine matter on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

How does the Board recommend that I vote?

The board of directors recommends that you vote:

•“For” the nominees for election as director; and

•“For” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

If you vote via the Internet, by telephone, or sign and return the proxy card by mail but do not make specific choices, your shares, as permitted, will be voted as recommended by our board of directors. If any other matter is presented at the annual meeting, your proxy will vote in accordance with his or her best judgment. As

of the date of this proxy statement, we know of no matters that need to be acted on at the annual meeting, other than those discussed in this proxy statement.

Who is paying the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors, officers, and other employees may solicit proxies in person or by mail, telephone, fax, or email. We will not pay our directors, officers, and other employees any additional compensation for these services. We will ask banks, brokers, and other institutions, nominees, and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We have engaged Alliance Advisors LLC (Alliance) to assist us in soliciting proxies for the Annual Meeting. We will pay Alliance a base fee of $15,000, plus reasonable out-of-pocket expenses, plus an additional fee based upon the number of contacts with stockholders made and work performed. We estimate the total amount payable to Alliance will be approximately $20,000. We will then reimburse them for their expenses.

How do I obtain an Annual Report on Form 10-K?

If you would like a copy of our Annual Report on Form 10-K for the year ended December 31, 2023 (the 2023 Annual Report) that we filed with the SEC on March 21, 2024, we will send you one without charge. Please write to:

150 N. Radnor Chester Rd, Suite F200

Radnor, PA 19087

Attn: Chief Financial Officer & Secretary

All of our SEC filings are also available free of charge in the “Investor Relations—SEC Filings” section of our website at https://mineralystx.com.

How can I find out the results of the voting at the annual meeting?

Final voting results will be published in our current report on Form 8-K to be filed with the SEC within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

PROPOSAL 1:

ELECTION OF DIRECTOR

Our board of directors is divided into three classes, with one class of our directors standing for election each year, generally for a three-year term. Directors for each class are elected at the annual meeting of stockholders held in the year in which the term for their class expires and hold office until the third annual meeting following election and until such director’s successor is elected and qualified, or until such director’s earlier death, resignation, disqualification or removal. As detailed below, the composition of our board of directors is as follows: Class I consists of Alexander Asam, Ph.D. and Jon Congleton; Class II consists of Derek DiRocco, Ph.D., Olivier Litzka, Ph.D., and Glenn P. Sblendorio; and Class III consists of Srinivas Akkaraju, M.D., Ph.D., Brian Taylor Slingsby, M.D., Ph.D., M.P.H., and Daphne Karydas.

Our amended and restated certificate of incorporation provides that the authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our board of directors or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock then entitled to vote in an election of directors.

At this meeting, one nominee for director is to be elected as a Class I director for a three-year term expiring at our 2027 annual meeting of stockholders and until his successor is duly elected and qualified. The nominee, who was recommended for nomination by the nominating and corporate governance committee of our board of directors, is Jon Congleton. On March 29, 2024, Alexander Asam, Ph.D., who is currently a Class I director, informed the board of directors of his decision not to stand for re-election when his current term expires at the annual meeting. The Class II directors have one year remaining on their terms of office and the Class III directors have two years remaining on their terms of office.

If no contrary indication is made, proxies in the accompanying form are to be voted for Mr. Congleton, or if Mr. Congleton is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our board of directors to fill the vacancy. Mr. Congleton is currently a member of our board of directors.

All of our directors bring to the board of directors significant leadership experience derived from their professional experience and service as executives or board members of other corporations and/or private equity and venture capital firms. The process undertaken by the nominating and corporate governance committee in recommending qualified director candidates is described below under “Director Nomination Process.” Certain individual qualifications and skills of our directors that contribute to the board of directors’ effectiveness as a whole are described in the following paragraphs.

Information Regarding Directors

The information set forth below as to the directors and nominee for director has been furnished to us by the directors and nominee for director:

Nominee for Election to the Board of Directors

For a Three-Year Term Expiring at the

2027 Annual Meeting of Stockholders (Class I)

| | | | | | | | | | | | | | |

| Name | | Age | | Present Position with Mineralys Therapeutics, Inc. |

| | | | |

Jon Congleton | | 60 | | Chief Executive Officer & Director |

Jon Congleton has served as our Chief Executive Officer and as a member of our board of directors since November 2020. Prior to joining us, Mr. Congleton was the Chief Executive Officer of Impel NeuroPharma, Inc. from September 2017 to May 2020. Prior to that, he served as the Chief Executive Officer and as a director of Nivalis Therapeutics, Inc. from January 2015 to February 2017. Mr. Congleton was previously at Teva Pharmaceutical Industries, Ltd. (Teva) where over 18 years he held positions in general management and global strategic marketing, including Senior Vice President of Teva’s Global Central Nervous System Disorders from April 2013 to December 2014, Senior Vice President of the Global Medicine Group from November 2011 to April 2013, and General Manager of Teva Neuroscience, Inc. in the United States. Prior to joining Teva, Mr. Congleton spent ten years in a variety of commercial roles with predecessor companies of Sanofi. Mr. Congleton earned a B.S. in marketing from Kansas State University. Mr. Congleton’s knowledge of our business and his extensive executive experience at multiple biopharmaceutical companies contributed to our board of directors’ conclusion that he should serve as a director of our Company.

Members of the Board of Directors Continuing in Office

Term Expiring at the

2025 Annual Meeting of Stockholders (Class II)

| | | | | | | | | | | | | | |

| Name | | Age | | Present Position with Mineralys Therapeutics, Inc. |

Derek DiRocco, Ph.D. | | 43 | | Director |

Olivier Litzka, Ph.D. | | 56 | | Director |

Glenn P. Sblendorio | | 68 | | Director |

Derek DiRocco, Ph.D. has served on our board of directors since May 2022. Dr. DiRocco has been a partner at RA Capital Management, L.P., a multi-stage investment manager dedicated to evidence-based investing in healthcare and life science companies that are developing drugs, medical devices, and diagnostics, since December 2020 and was previously a principal from December 2017 until December 2020, an analyst from June 2015 to December 2017 and an associate from July 2013 to June 2015. Dr. DiRocco has served on the board of directors of 89bio, Inc. since April 2018 and Werewolf Therapeutics, Inc. since January 2021, each of which is a publicly-traded biotechnology company. Dr. DiRocco previously served on the board of directors of Achilles Therapeutics plc, Connect Biopharma Holdings Limited, and iTeos Therapeutics, Inc., and also serves on the board of directors of several privately held biotechnology companies. Dr. DiRocco holds a B.A. in biology from College of the Holy Cross and a Ph.D. in pharmacology from the University of Washington. He conducted his postdoctoral research at Brigham and Women’s Hospital/Harvard Medical School. Dr. DiRocco’s extensive investment experience in biopharmaceutical companies, as well as his academic background and public company board experience, contributed to our board of directors’ conclusion that he should serve as a director of our Company.

Olivier Litzka, Ph.D. has served on our board of directors since May 2022. Dr. Litzka has served as a partner at Andera Partners, a venture capital firm, since 2006 and started his business career in 1998 with Mercer Management Consulting. In 2000, he joined 3i Group plc with a focus on biopharma and medtech investments. Dr. Litzka currently serves on the boards of Medical Microinstruments, T-Knife, Allecra Therapeutics, HighLife Medical, MedLumics, Ariceum Therapeutics, and JenaValve. He was also a board member of Corvidia, Sapiens, Endosense, Novexel, Supersonic Imagine, and Arvelle Therapeutics, up until their respective acquisitions. Dr. Litzka has a Ph.D. in molecular microbiology from the Institut für Genetik und Mikrobiologie in Munich. Dr. Litzka’s extensive investment experience in the biopharmaceutical industry contributed to our board of directors’ conclusion that he should serve as a director of our Company.

Glenn P. Sblendorio has served on our board of directors since September 2023. Most recently, Mr. Sblendorio was Chief Executive Officer and a member of the board of directors of IVERIC bio, Inc., a publicly-held biotechnology company (formerly Ophthotech Corporation), from July 2017 until it was acquired by Astellas Pharma in July of 2023. Prior to IVERIC, Mr. Sblendorio was President and Chief Financial Officer of The Medicines Company from March 2006 through March 2016 and was a member of the board of directors of

The Medicines Company from July 2011 through December 2015. Before joining The Medicines Company, Mr. Sblendorio was Executive Vice President and Chief Financial Officer of Eyetech Pharmaceuticals, Inc. from February 2002 until it was acquired by OSI Pharmaceuticals, Inc. in November 2005. Mr. Sblendorio also served as a Managing Director of MPM Capital Advisors from 1998 through 2000. Mr. Sblendorio also serves as a member of the board of directors of Amicus Therapeutics, Inc. and Nanoscope Therapeutics, Inc. and previously served on the board of directors of Intercept Pharmaceuticals, Inc. Mr. Sblendorio received his B.B.A. from Pace University and his M.B.A. from Fairleigh Dickinson University and is a graduate of the Harvard Advanced Management Program. Mr. Sblendorio’s executive experience at multiple biopharmaceutical companies and experience on numerous public company boards of directors contributed to our board of directors’ conclusion that he should serve as a director of our Company.

Members of the Board of Directors Continuing in Office

Term Expiring at the

2026 Annual Meeting of Stockholders (Class III)

| | | | | | | | | | | | | | |

| Name | | Age | | Present Position with Mineralys Therapeutics, Inc. |

Brian Taylor Slingsby, M.D., Ph.D., M.P.H. | | 47 | | Executive Chairman and Founder |

Srinivas Akkaraju, M.D., Ph.D. | | 56 | | Director |

Daphne Karydas | | 51 | | Director |

Brian Taylor “BT” Slingsby, M.D., Ph.D., M.P.H. founded Mineralys on May 31, 2019 and has served on our board of directors since that time as Executive Chairman. Dr. Slingsby is Founder & Managing Partner at Catalys Pacific, a venture capital firm focused on life sciences. In addition to serving as founding CEO of Mineralys during its inception and incubation, Dr. Slingsby has served as founding CEO of Pathalys Pharma, Inc., Kirilys Therapeutics, Inc., and Aculys Pharma, KK. Previous to Catalys Pacific, he founded the Global Health Innovative Technology Fund, the world’s first public-private fund focused on the development of new medicines for low- and middle-income countries. Dr. Slingsby graduated from Brown University with honors, earned his M.P.H. and Ph.D. from Kyoto University and the University of Tokyo, and received his M.D. with honors from the George Washington University. Dr. Slingsby’s investment experience in the biopharmaceutical industry, as well as his academic background and experience on numerous public and private company boards of directors, contributed to our board of directors’ conclusion that he should serve as a director of our Company.

Srinivas Akkaraju, M.D., Ph.D. has served on our board of directors since February 2021. Dr. Akkaraju has served as Managing General Partner of Samsara BioCapital, a venture capital firm, since he founded the firm in 2017. From April 2013 to March 2017, Dr. Akkaraju was a General Partner and then a Senior Advisor of Sofinnova Ventures, a venture capital firm focused on the life sciences industry. From January 2009 until April 2013, Dr. Akkaraju was a Managing Director of New Leaf Venture Partners, an investment firm focused on the healthcare technology sector. From 2006 to 2008, Dr. Akkaraju served as a Managing Director of Panorama Capital, a venture capital firm that he co-founded along with other members of the former venture capital investment team of J.P. Morgan Partners, a private equity division of JPMorgan Chase & Co. Prior to co-founding Panorama Capital, Dr. Akkaraju was with J.P. Morgan Partners, which he joined in 2001 and of which he became a partner in 2005. From 1998 to 2001, Dr. Akkaraju worked in business and corporate development at Genentech, Inc. (now a member of the Roche Group), a biotechnology company. Dr. Akkaraju has been a director of publicly-traded biopharmaceutical companies Scholar Rock since July 2022 and Syros Pharmaceuticals, Inc. since June 2017. Dr. Akkaraju also serves on the board of directors of a number of private companies. During the past five years, Dr. Akkaraju previously served as a director of Chinook Therapeutics, Intercept Pharmaceuticals, Aravive, Inc. (formerly Versartis, Inc.), aTyr Pharma, Inc., Jiya Acquisition Corp., Principia Biopharma Inc. and Seattle Genetics, Inc. (now Seagen Inc.). Dr. Akkaraju received his M.D. and a Ph.D. in Immunology from Stanford University and holds undergraduate degrees in Biochemistry and Computer Science from Rice University. Dr. Akkaraju’s extensive investment experience in the biopharmaceutical industry, as well as his scientific background and experience on numerous public and private

company boards of directors, contributed to our board of directors’ conclusion that he should serve as a director of our Company.

Daphne Karydas, M.B.A., has served on our board of directors since September 2023. Since October 2021, Ms. Karydas has served as President and Chief Financial Officer of Flare Therapeutics Inc., a pre-clinical pharmaceutical company, since October 2021. Prior to joining Flare, she served as the Chief Financial Officer of Syndax Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, from July 2020 to October 2021. Ms. Karydas previously served as Senior Vice President of Corporate Strategy and Financial Planning & Analysis at Allergan plc, where she oversaw the company’s long-term financial and business strategy, until its acquisition by AbbVie Inc. in May 2020. She joined Allergan in April 2017 as Senior Vice President of Global Investor Relations and Strategy, leading engagement with the investment community and business strategy development. Prior to joining Allergan, she served as Executive Director and Senior Healthcare Analyst at J.P. Morgan Asset Management from January 2015 to April 2017. Previously, she was a Portfolio Manager and Senior Healthcare Analyst at The Boston Company Asset Management, a BNY Mellon company. Earlier in her career, Ms. Karydas was a Vice President at Goldman Sachs Asset Management focused on healthcare, as well as a member of Goldman Sachs’ healthcare investment banking team. Before joining Goldman Sachs, she was a Project Chemical Engineer at Merck & Co. where she focused on process development for novel vaccines. Ms. Karydas has served on the board of directors of COMPASS Pathways plc since September 2023 and previously served on the board of directors of LogicBio Therapeutics, prior to its acquisition by Alexion Pharmaceuticals, Inc. in October 2022, and the board of directors of Eucrates Biomedical Acquisition Corp. Ms. Karydas received a B.A. and M.S. in chemical engineering from the Massachusetts Institute of Technology and an M.B.A. from Harvard Business School. Ms. Karydas’ extensive executive leadership and strategy experience at multiple biopharmaceutical companies and experience on numerous public and private company boards of directors contributed to our board of directors’ conclusion that she should serve as a director of our Company.

Director Independence

Our board of directors currently consists of eight members. Our board of directors has determined that all of our directors, other than Mr. Congleton, are independent directors in accordance with the listing requirements of the Nasdaq Stock Market (Nasdaq). The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his or her family members has engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our board of directors has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of the director. In making these determinations, our board of directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

Board of Directors Leadership Structure

Our board of directors is currently chaired by Dr. Slingsby. Our board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the company continues to grow. We separate the roles of chief executive officer and chairman of the board of directors in recognition of the differences between the two roles. The chief executive officer is responsible for setting the strategic direction for our Company and the day-to-day leadership and performance of our Company, while the chairman of the board of directors provides guidance to the chief executive officer and presides over meetings of the full board of directors. We believe that this separation of responsibilities provides a balanced approach to managing the board of directors and overseeing our Company. Our board of directors has concluded that our current leadership structure is appropriate at this time. However, our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board of Directors in Risk Oversight Process

Our board of directors has responsibility for the oversight of our risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business, and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board of directors to understand our risk identification, risk management, and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, and reputational risk.

The audit committee reviews information regarding liquidity and operations and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, including with respect to cybersecurity, loss prevention, and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor, or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The nominating and corporate governance committee manages risks associated with the independence of the board of directors, corporate disclosure practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board of directors as a whole.

Board of Directors Meetings

Our board of directors met ten times during fiscal year 2023. In that year, each director attended at least 75% of the total number of meetings of the board of directors and each committee of the board of directors on which such director served during the period in which he or she served as a director.

Board of Directors Committees and Independence

Our board of directors has established three standing committees – audit, compensation, and nominating and corporate governance – each of which operates under a charter that has been approved by our board of directors. You can access our current committee charters under the “Investor Relations—Governance” section of our website at www.mineralystx.com.

Audit Committee

The audit committee’s main function is to oversee our accounting and financial reporting processes and the audits of our financial statements. This committee’s responsibilities include, among other things:

•appointing our independent registered public accounting firm;

•evaluating the qualifications, independence, and performance of our independent registered public accounting firm;

•approving the audit and non-audit services to be performed by our independent registered public accounting firm;

•reviewing the design, implementation, adequacy, and effectiveness of our internal accounting controls and our critical accounting policies;

•discussing with management and the independent registered public accounting firm the results of the audit of our annual financial statements and the review of our quarterly unaudited financial statements;

•reviewing, overseeing, and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters;

•reviewing on a periodic basis, or as appropriate, any investment policy and recommending to our board of directors any changes to such investment policy;

•reviewing with management and our auditors any earnings announcements and other public announcements regarding our results of operations;

•preparing the report that the SEC requires in our annual proxy statement;

•reviewing and approving any related party transactions and reviewing and monitoring compliance with our code of conduct and ethics; and

•reviewing and evaluating, at least annually, the performance of the audit committee and its members, including compliance of the audit committee with its charter.

The members of our audit committee are Ms. Karydas, Dr. DiRocco, and Dr. Asam. Ms. Karydas serves as the chairperson of the committee. All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and Nasdaq. Our board of directors has determined that Ms. Karydas is an “audit committee financial expert” as defined by applicable SEC rules and has the requisite financial sophistication as defined under the applicable Nasdaq listing standards. Our board of directors has determined each of Ms. Karydas, Dr. DiRocco, and Dr. Asam is independent under the applicable rules of the SEC and Nasdaq. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq, which the audit committee reviews and evaluates at least annually. The audit committee met four times during 2023.

Compensation Committee

Our compensation committee approves policies relating to compensation and benefits of our officers and employees. The compensation committee approves corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, and approves the compensation of these officers based on such evaluations. The compensation committee also approves the issuance of stock options and other awards under our equity plans. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter.

The members of our compensation committee are Mr. Sblendorio, Dr. Akkaraju, and Dr. DiRocco. Mr. Sblendorio serves as the chairperson of the committee. Our board of directors has determined that each of Mr. Sblendorio, Dr. Akkaraju, and Dr. DiRocco. is independent under the applicable Nasdaq listing standards and is a “non-employee director” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the Exchange Act). The compensation committee operates under a written charter, which the compensation committee reviews and evaluates at least annually. The compensation committee met four times during 2023.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for assisting our board of directors in discharging the board of directors’ responsibilities regarding the identification of qualified candidates to become board members, the selection of nominees for election as directors at our annual meetings of stockholders (or special meetings of stockholders at which directors are to be elected), and the selection of candidates to fill any vacancies on our board of directors and any committees thereof. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies, reporting and making recommendations to our board of directors concerning governance matters,

reviewing and assisting the board of directors with oversight of matters relating to environmental, social, and governance matters affecting our Company, and providing oversight of the evaluation of our board of directors. The members of our nominating and corporate governance committee are Dr. Slingsby, Dr. Akkaraju, and Dr. Litzka. Dr. Slingsby serves as the chairperson of the committee. Our board of directors has determined that each of Dr. Slingsby, Dr. Akkaraju, and Dr. Litzka is independent under the applicable Nasdaq listing standards. The nominating and corporate governance committee operates under a written charter, which the nominating and corporate governance committee reviews and evaluates at least annually. The nominating and corporate governance committee met one time during 2023.

Report of the Audit Committee of the Board of Directors

The audit committee oversees the Company’s accounting and financial reporting process and audits on behalf of the Company’s board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in the Company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed with Ernst & Young LLP, which is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards and the matters listed in Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with Audit Committees. In addition, the audit committee has discussed with Ernst & Young LLP its independence from management and the Company, has received from Ernst & Young LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young LLP’s communications with the audit committee concerning independence, and has considered the compatibility of non-audit services with the auditors’ independence.

The audit committee met with Ernst & Young LLP to discuss the overall scope of its services, the results of its audit and reviews, and the overall quality of the Company’s financial reporting. Ernst & Young LLP, as the Company’s independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the Company’s reporting. The audit committee’s meetings with Ernst & Young LLP were held with and without management present. The audit committee is not employed by the Company, nor does it provide any expert assurance or professional certification regarding the Company’s financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to the Company’s board of directors that the audited financial statements be included in the Company’s 2023 Annual Report. The audit committee and the Company’s board of directors also have recommended, subject to stockholder approval, the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024.

This report of the audit committee is not “soliciting material,” shall not be deemed “filed” with the SEC, and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended (the Securities Act), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

Respectfully submitted,

The Audit Committee of the Board of Directors

Daphne Karydas (Chairperson)

Alexander Asam, Ph.D.

Derek DiRocco, Ph.D.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee has ever been one of our officers or employees. None of our executive officers currently serves or has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Director Nomination Process

Director Qualifications

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills, and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members) for election or appointment, the nominating and corporate governance committee and the board of directors will take into account many factors, including the following:

•personal and professional integrity, ethics, and values;

•experience in corporate management, such as serving as an officer or former officer of a publicly-held company;

•experience as a board member or executive officer of another publicly-held company;

•strong finance experience;

•diversity of expertise and experience in substantive matters pertaining to our business relative to other board members;

•diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence, and specialized experience;

•experience relevant to our business industry and with relevant social policy concerns; and

•relevant academic expertise or other proficiency in an area of our business operations.

Our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the nominating and corporate governance committee may also consider such other factors as it may deem to be in the best interests of our Company and our stockholders. The nominating and corporate governance committee does, however, believe it appropriate for at least one, and preferably, several, members of our board of directors to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of our board of directors meet the definition of “independent director” under Nasdaq qualification standards.

Identification and Evaluation of Nominees for Directors

The nominating and corporate governance committee identifies nominees for director by first evaluating the current members of our board of directors willing to continue in service. Current members with qualifications and skills that are consistent with the nominating and corporate governance committee’s criteria for board of director service and who are willing to continue in service are considered for re-nomination,

balancing the value of continuity of service by existing members of our board of directors with that of obtaining a new perspective or expertise.

If any member of our board of directors does not wish to continue in service or if our board of directors decides not to re-nominate a member for re-election or if the board of directors decides to expand the size of the board, the nominating and corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. The nominating and corporate governance committee generally polls our board of directors and members of management for their recommendations. The nominating and corporate governance committee may also review the composition and qualification of the boards of directors of our competitors and may seek input from industry experts or analysts. The nominating and corporate governance committee reviews the qualifications, experience, and background of the candidates. Final candidates are interviewed by the members of the nominating and corporate governance committee and by certain of our other independent directors and executive management. In making its determinations, the nominating and corporate governance committee evaluates each individual in the context of our board of directors as a whole, with the objective of assembling a group that can best contribute to the success of our Company and represent stockholder interests through the exercise of sound business judgment. After review and deliberation of all feedback and data, the nominating and corporate governance committee makes its recommendation to our board of directors. The nominating and corporate governance committee may rely on third-party search firms to identify director candidates, especially in situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

The nominating and corporate governance committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees. We have not received director candidate recommendations from our stockholders, and we do not have a formal policy regarding consideration of such recommendations. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by members of our board of directors, management, or other parties are evaluated.

Under our amended and restated bylaws, a stockholder wishing to suggest a candidate for director should write to our corporate secretary and provide such information about the stockholder and the proposed candidate as is set forth in our amended and restated bylaws and as would be required by SEC rules to be included in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any agreements, arrangements, or understandings between the stockholder and the candidate regarding the nomination. In order to give the nominating and corporate governance committee sufficient time to evaluate a recommended candidate and include the candidate in our proxy statement for the 2025 annual meeting, the recommendation should be received by our corporate secretary at our principal executive offices in accordance with our procedures detailed in the section below titled “Stockholder Proposals.”

Board Diversity Matrix (as of March 15, 2024)

The following table summarizes certain self-identified characteristics of our directors, utilizing the categories and terms set forth in applicable Nasdaq rules and related guidance:

| | | | | | | | | | | | | | |

| Total Number of Directors | | 8 |

| | Female | | Male |

| Part I: Gender Identity | | | | |

| Directors | | 1 | | 7 |

| Part II: Demographic Background | | | | |

| Asian | | | | 1 |

| White | | 1 | | 6 |

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our board of directors at our annual meeting, we encourage all of our directors to attend the meeting.

Communications with our Board of Directors

Our board of directors will give appropriate attention to written communications that are submitted by stockholders and will respond if and as appropriate. Our Chief Financial Officer and Secretary is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Corporate Secretary and Executive Chairman of the board of directors consider to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances, and matters as to which we tend to receive repetitive or duplicative communications. Stockholders who wish to send communications on any topic to the board of directors should address such communications to the board of directors in writing to Mineralys Therapeutics, Inc., Attn: Chief Financial Officer and Secretary, 150 N. Radnor Chester Road, Suite F200, Radnor, PA 19087.

Code of Business Conduct and Ethics

We adopted a written code of business conduct and ethics that applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our code of business conduct and ethics is available under the “Investor Relations—Governance” section of our website at www.mineralystx.com. In addition, we intend to post on our website all disclosures that are required by law or the listing standards of Nasdaq concerning any amendments to, or waivers from, any provision of the code.

Prohibition Against Pledging and Hedging

We maintain an insider trading compliance policy that prohibits our officers, directors, and employees from pledging our stock as collateral to secure loans and from engaging in hedging transactions, including zero-cost collars and forward sale contracts. It further prohibits margin purchases of our stock, short sales of our stock, and any transactions in puts, calls, or other derivative securities involving our stock.

Vote Required; Recommendation of the Board of Directors

If a quorum is present and voting at the annual meeting, a director shall be elected by a plurality of votes cast, meaning that the nominee receiving the highest number of shares voted “For” his election will be elected to our board of directors. Votes withheld from our nominee and abstentions will be counted only for purposes of determining a quorum and are not considered votes cast for the foregoing purpose. Broker non-votes will have no effect on this proposal as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF JON CONGLETON. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE.

PROPOSAL 2:

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024, and our board of directors has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the annual meeting. Ernst & Young LLP has audited the Company’s financial statements since 2022. Representatives of Ernst & Young LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is not required by Delaware law, the Company’s amended and restated certificate of incorporation, or the Company’s amended and restated bylaws. However, the audit committee is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether to retain that firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered accounting firm at any time during the year if the audit committee determines that such a change would be in the best interests of the Company and its stockholders.

Independent Registered Public Accounting Firms Fees

Ernst & Young LLP has served as the Company’s independent registered public accounting firm since 2022. The following table sets forth the aggregate fees and expenses billed to us by Ernst & Young LLP (in thousands):

| | | | | | | | | | | |

| 2023 | | 2022 |

Audit Fees (1) | $ | 374 | | | $ | 1,061 | |

| Audit-Related Fees | — | | | — | |

| Tax Fees | — | | | — | |

| All Other Fees | — | | | — | |

| Total | $ | 374 | | | $ | 1,061 | |

______________

(1)Audit fees consist of fees for professional services rendered for the audit of our year-end consolidated financial statements and services that are normally provided by our independent registered public accounting firm in connection with regulatory filings. These services include auditing work in connection with the Company’s initial public offering (IPO).

The audit committee has considered whether the provision of non-audit services is compatible with maintaining the independence of Ernst & Young LLP, and has concluded that the provision of such services is compatible with maintaining the independence of our auditors.

Pre-Approval Policies and Procedures

Our audit committee has established a policy that all audit and permissible non-audit services provided by our independent registered public accounting firm will be pre-approved by the audit committee, and all such services were pre-approved in accordance with this policy during the fiscal year ended December 31, 2023. These services may include audit services, audit-related services, tax services, and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our auditors. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the

independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

Vote Required; Recommendation of the Board of Directors

The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively on the proposal will be required to ratify the selection of Ernst & Young LLP, meaning the number of shares voted “For” the proposal must exceed the number of shares voted “Against” the proposal. Abstentions will not be counted toward the tabulation of votes cast on this proposal and will have no effect on the proposal. The approval of Proposal 2 is a routine proposal on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock as of March 15, 2024 by:

•our named executive officers;

•each of our directors;

•all of our executive officers and directors as a group; and

•each person or group of affiliated persons known by us to beneficially own more than 5% of our common stock.

The number of shares beneficially owned by each stockholder is determined under rules issued by the SEC. Under these rules, beneficial ownership includes any shares as to which a person has sole or shared voting power or investment power. Applicable percentage ownership is based on 49,631,159 shares of common stock outstanding as of March 15, 2024. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or other rights held by such person that are currently exercisable or that will become exercisable or otherwise vest within 60 days of March 15, 2024 are considered outstanding, although these shares are not considered outstanding for purposes of computing the percentage ownership of any other person.

Unless otherwise indicated, the address of each beneficial owner listed below is c/o Mineralys Therapeutics, Inc., 150 N. Radnor Chester Road, Suite F200, Radnor, Pennsylvania 19087. We believe, based on information provided to us, that each of the stockholders listed below has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

| | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Number of Shares Beneficially Owned | | Percentage of Shares Beneficially Owned |

| 5% or Greater Stockholders | | | | |

| Catalys Pacific Fund, LP (1) | | 9,212,912 | | 18.56% |

| Samsara BioCapital, L.P. (2) | | 5,074,916 | | 10.23% |

| Entities affiliated with RA Capital Management, L.P. (3) | | 4,970,047 | | 9.99% |

| | | | |

| TCG Crossover Fund II, L.P. (4) | | 3,185,185 | | 6.42% |

| BioDiscovery 6 FPCI (5) | | 2,865,976 | | 5.77% |

| | | | |

| Named Executive Officers and Directors | | | | |

| Jon Congleton (6) | | 1,750,374 | | 3.48% |

| Adam Levy (7) | | 481,574 | | * |

| David Rodman, M.D. (8) | | 353,281 | | * |

| Brian Taylor Slingsby, M.D., Ph.D., M.P.H. (1)(9) | | 9,212,912 | | 18.56% |

| Srinivas Akkaraju, M.D., Ph.D. (2)(10) | | 5,093,249 | | 10.26% |

| Alexander Asam, Ph.D. (11) | | — | | * |

| Derek DiRocco, Ph.D. (12) | | 18,333 | | * |

| Olivier Litzka, Ph.D. (13) | | 18,333 | | * |

| Daphne Karydas (14) | | 9,777 | | * |

| Glenn Sblendorio (15) | | 9,777 | | * |

| All current executive officers and directors as a group (10 persons) (16) | | 16,947,610 | | 33.24% |

__________________

*Less than 1%.

(1)Based on information contained in the Schedule 13G filed with the SEC on February 13, 2024 by Catalys Pacific Fund, LP. Includes (i) 9,194,579 shares of common stock held by Catalys Pacific Fund, LP and (ii) 18,333 shares issuable upon the exercise of options held by Brian Taylor Slingsby within 60 days of March 15, 2024. The general partner of Catalys Pacific Fund, LP is Catalys Pacific Fund GP, LP. Brian Taylor Slingsby is the managing member of Catalys Pacific, LLC, the general partner of the General Partner. Catalys Pacific Fund GP, LP and Brian Taylor Slingsby may be deemed to have voting and investment power over the shares held of record by Catalys Pacific Fund, LP. Catalys Pacific Fund GP, LP and Brian Taylor Slingsby disclaim beneficial ownership of such shares, except to the extent of any pecuniary interest therein. The address of the entity listed above is PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

(2)Based on information contained in the Schedule 13D filed with the SEC on February 12, 2024 by Samsara BioCapital, L.P. Includes 5,074,916 shares of common stock held by Samsara BioCapital, L.P. Samsara BioCapital GP, LLC (Samsara LLC) is the general partner of Samsara BioCapital, L.P. (Samsara LP) and may be deemed to beneficially own the shares held by Samsara LP. Dr. Akkaraju has voting and investment power over the shares held by Samsara LP and, accordingly, may be deemed to beneficially own the shares held by Samsara LP. Each of Samsara LLC and Dr. Akkaraju disclaims beneficial ownership in these shares except to the extent of his or its respective pecuniary interest therein.

(3)Based on information contained in the Schedule 13D/A filed with the SEC on February 12, 2024 by RA Capital Management, L.P. Includes (i) 2,983,755 shares of common stock held by RA Capital Healthcare Fund, L.P. (RA Healthcare); (ii) 1,867,229 shares of common stock held by RA Capital Nexus Fund III, L.P. (Nexus III); (iii) a total of 15,888 shares underlying vested stock options held by Dr. Derek DiRocco for the benefit of RA Capital Management, L.P.; and (iv) 2,445 shares underlying stock options which shall vest within 60 days of March 15, 2024 held by Dr. DiRocco for the benefit of RA Capital Management, L.P. RA Healthcare also holds pre-funded warrants through which it has a right to acquire 549,755 shares of common stock (the Pre-Funded Warrants). The Pre-Funded Warrants contain a provision (the Beneficial Ownership Blocker) which precludes exercise of the Pre-Funded Warrants to the extent that, following exercise, RA Healthcare, together with its affiliates and other attribution parties, would own more than 9.99% of our common stock outstanding. RA Healthcare is currently prohibited from exercising the Pre-Funded Warrants to the extent that the exercise would result in beneficial ownership of more than 4,970,047 shares of common stock by entities affiliated with RA Capital Management, L.P.

RA Capital Management, L.P. is the investment manager for RA Healthcare and Nexus III. The general partner of RA Capital Management, L.P. is RA Capital Management GP, LLC, of which Peter Kolchinsky, Ph.D. and Rajeev Shah are the managing members. RA Capital Management, L.P., RA Capital Management GP, LLC, Peter Kolchinsky, Ph.D. and Rajeev Shah may be deemed to have voting and investment power over the shares held of record by RA Healthcare and Nexus III. RA Capital

Management, L.P., RA Capital Management GP, LLC, Peter Kolchinsky, Ph.D. and Rajeev Shah disclaim beneficial ownership of such shares, except to the extent of any pecuniary interest therein. The address of the entities listed above is 200 Berkeley Street, 18th Floor, Boston, Massachusetts 02116.

(4)Based on information contained in the Schedule 13G filed with the SEC on February 15, 2024 by TCG Crossover GP II, LLC. TCG Crossover GP II, LLC is the general partner of TCG Crossover Fund II, L.P. and may be deemed to have voting, investment, and dispositive power with respect to these securities. Chen Yu is the sole managing member of TCG Crossover GP II, LLC and may be deemed to share voting, investment, and dispositive power with respect to these securities. The address of the entity listed above is 705 High St., Palo Alto, CA 94301.

(5)Based on information contained in the Schedule 13G filed with the SEC on February 24, 2023 by BioDiscovery 6 FPCI. Voting and dispositive decisions with respect to the securities held by BioDiscovery 6 FPCI are made by its management company, Andera Partners. The Managing Partners of Andera Partners consist of Raphaël Wisniewski and Laurent Tourtois, none of whom has individual voting or investment power with respect to the shares.

(6)Includes 405,167 shares subject to repurchase by us within 60 days after March 15, 2024 and 296,139 shares of common stock issuable upon the exercise of options within 60 days of March 15, 2024.